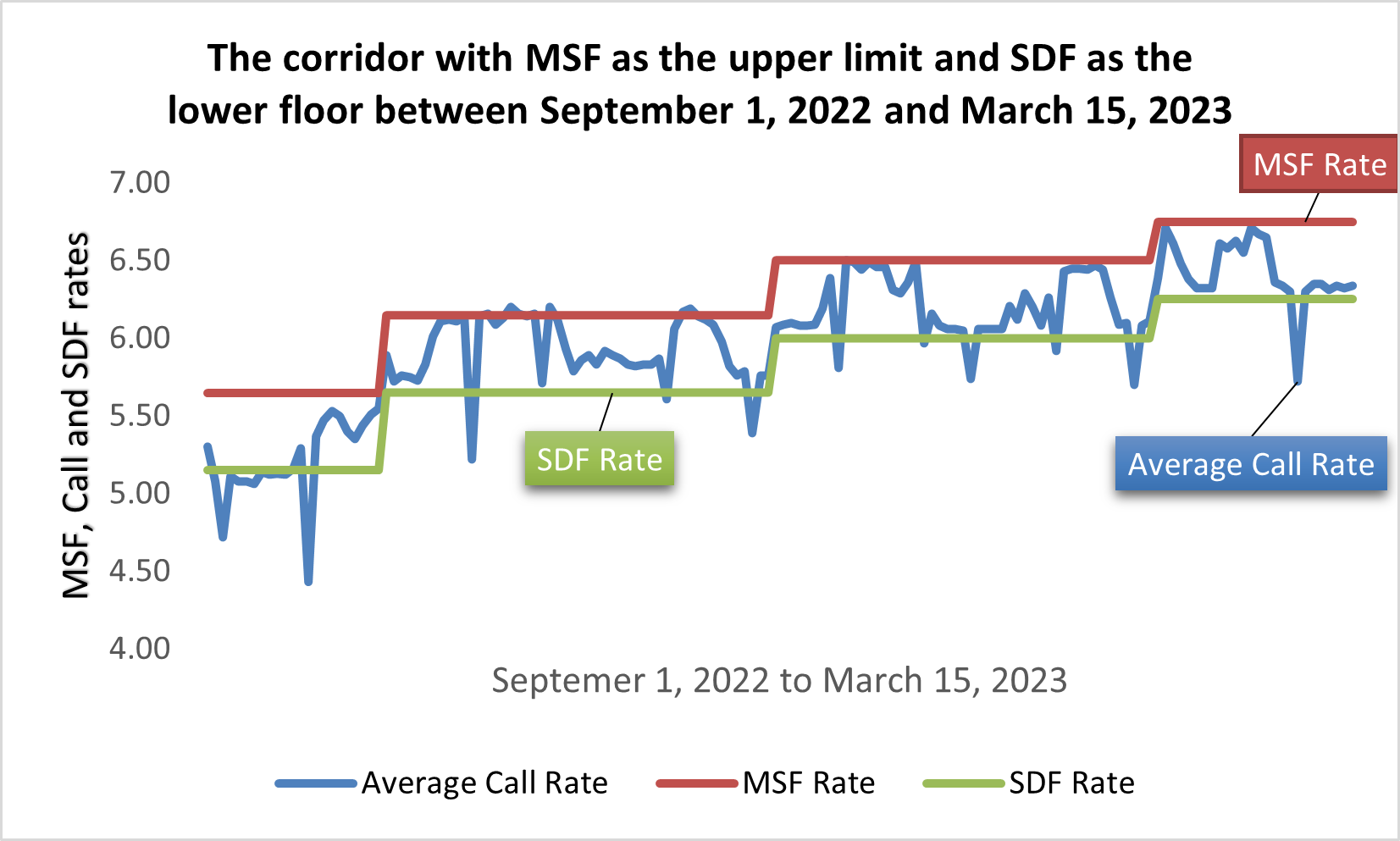

The Corridor in the monetary policy of the RBI refers to the area between the Marginal Standing Facility Rate which is the emergency lending rate and the Standing Deposit Facility (SDF) rate which is the liquidity absorption rate. The significance of the corridor is that ideally, the call rate should travel between the corridor, and this shows a comfortable liquidity situation in the system. Previously, the corridor had the upper ceiling of MSF and the lower ceiling of reverse repo. But after the SDF became the active liquidity absorption instrument, it has been inducted as the lower ceiling replacing the Reverse Repo Rate.

Corridor and its monetary policy significance.

As per the monetary policy of the RBI, ideally, the call rate should travel within the corridor showing a comfortable liquidity situation in the financial system and economy.

The corridor structure for the policy rate is a helping guide for the RBI to design its monetary policy operations. Call money rate is the operating target of monetary policy. As far as the call rate lies within the corridor, there is not much liquidity disturbance in the system.

The position of call rate is a suitable guide in designing the RBI’s liquidity stabilization response.

As of June, 2023, the SDF rate is 6.25 % , whereas the MSF rate is 6.75%. Hence, the corridor has a gap of 50 basis points.